CHAPTER XIII

Kalarhythms and the Market

economic analysis found the Time Matrixes

under 2. Business & Economy

from 1776 through the 2000s.

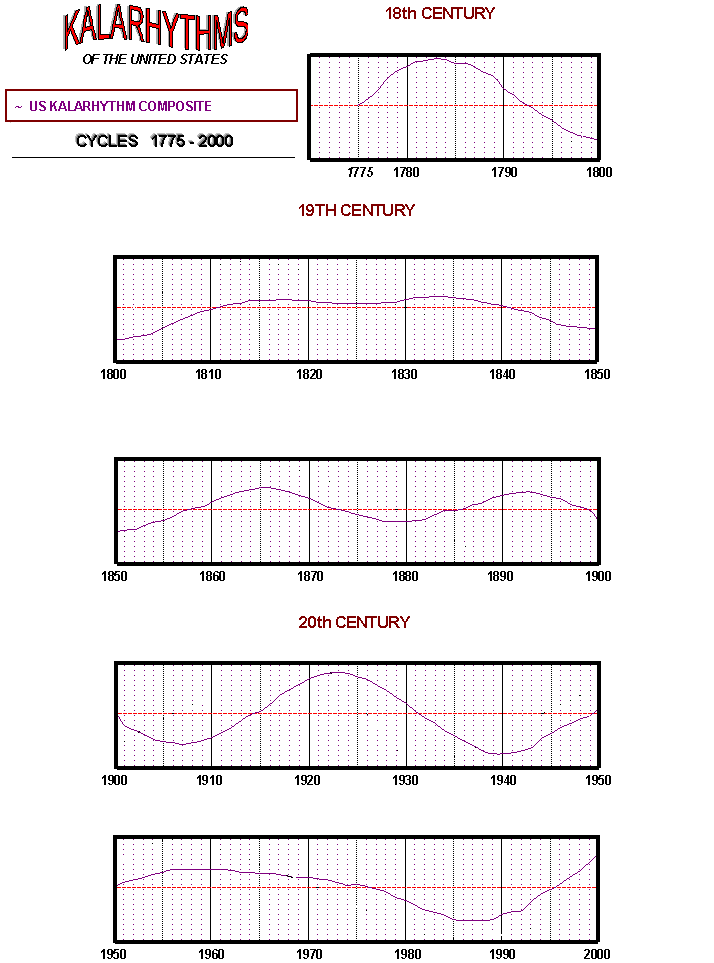

Figure #ma-01 shows the Cycle Composite for the Kalarhythms of the US:

Kondratieff’s work became one of the most widely known economic Cycle theories and is referred to as the Kondratieff Wave, K-Cycle, or K-Wave. Economist Joseph Alois Schumpeter believed that the correct duration of the K-Cycle was 56 years. Analysis of the K-Cycle vary and other economists described the K-Cycle as lasting from 49 to 54 years, differing between Cycles. Work at Harvard University determined a 54-year Cycle in wheat prices in the UK, and studies in interest rates have found tops that occurred every 54 to 60 years. Most agreed, however, that the K-Wave is some 50 to 60 years in length.

Next is a look at the Highs and Los of the Kondratieff Wave. The beginning of the wave is counted from the Trough, (not the midpoint). The first Wave began with a Trough in 1790. The first Peak, (as described by economist Nathan Mager who defined the Peaks), came in 1814. The next Tough of 1844-51 began the second K-Wave. This Peaked in 1864. A third K-Wave began with a Trough in 1890-96. It Peaked in 1920. Most analysts viewed the Great Depression as the beginning of a fourth Kondratieff Wave. Economists at that time projected a major bottom of the K-Wave would come in the 1980s. That puts us in a fifth K-Wave now.

Figure #ma-2 shows the Kondratieff Wave from the 1790s to 2000:

Figure #ma-3 shows a Cycle Composite for Kalarhythms in the US & the Kondratieff Wave:

K-Waves and Composite Waves are without symmetry or periodicity, and their durations change between waves. Despite these oddities, both Waves have followed nearly synchronized motion for two centuries. It may be that they are two views of the same process. Kondratieff and other economists used the anecdotal evidence of western economies. The Cycle Composite for Kalarhythms uses the mathematics of dynamic and universal patterns. The results are similar.

The Kondratieff Wave may Not be a True Cycle, rather, it may be the Combined Effect of Many Cycles in Motion

A Composite Wave forecast can look at combined energies to come. After our most recent Trough in 1988, a Peak, is set for 2004. Another Trough in 2021 would start a sixth Composite Wave, due to Peak in 2036. A Trough in 2049 would start the seventh Wave, set to Peak in 2063. The eighth Wave could begin with a Trough in 2077 and Peak in 2092. Given the consistencies so far, these are reasonable probabilities.

Happy Cycling!